Philippine Foreign Direct Investment Relatively Stagnant so Far in 2024 Amidst Analyst Concerns

August 20, 2024

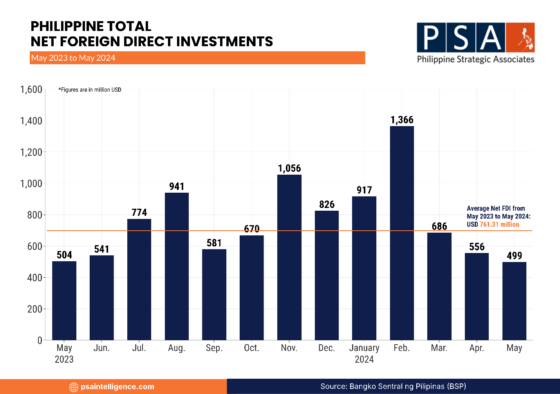

Preliminary reports from the Bangko Sentral ng Pilipinas (BSP) showed that the Philippines is on track to have a relatively average year in terms of FDI, with a decrease of approximately 1.0 percent compared to this point last year. Net FDI inflows decreased from USD 504 million in May 2023 to USD 499 million in May 2024.

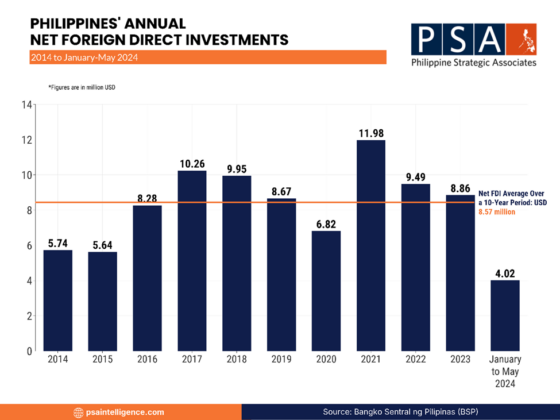

The graph above illustrates the annual net FDI into the Philippines from 2014 to January-May 2024. There has been an upward trend in FDI inflows, with a peak of USD 11.98 million observed in 2021. If the trend for 2024 so far continues, based upon the first five months of 2024, the Philippines will reach just above the average FDI over the last ten years.

More information about the net FDI as reported by the BSP can be accessed here.

Philippine Total Net FDI Trend (May 2023 to May 2024)

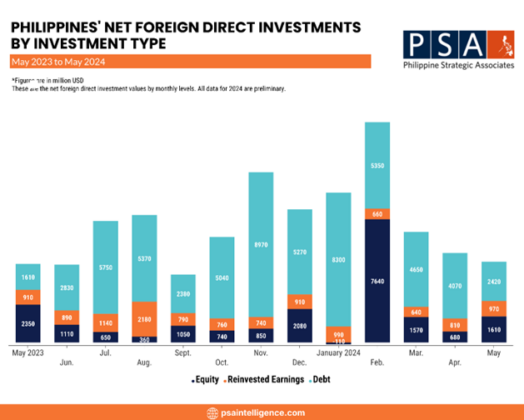

The month-to-month data shows a fluctuating trend in Philippine total net FDI from May 2023 to May 2024, with a peak of USD 1366 million in February 2024. FDI has been declining since February 2024, but month to month FDI in the Philippines regularly fluctuates heavily, and singularly large investments, sometimes in the billions of dollars, typically cause spikes in the month-to-month data. PSA analysts don’t put too much weight in the month-to-month fluctuations in FDI data.

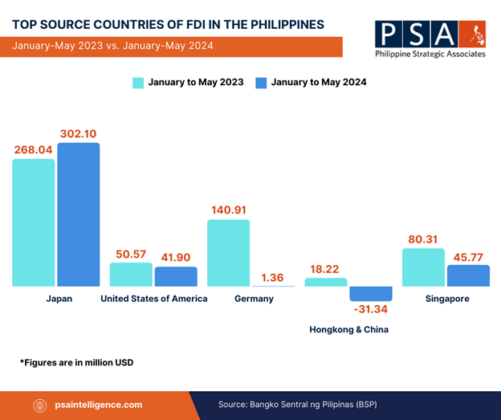

Top Source Countries of FDI in the Philippines (January to May 2023 vs January to May 2024)

This graph compares FDI sources in the Philippines between January-May 2023 and January-May 2024. Japan held its position as top investors throughout both periods, with Japan increasing its investment slightly in 2024. Notably, investments from the United States, Germany, Hong Kong and China, and Singapore declined in 2024.

The countries listed in the chart are known for their longstanding investments in the Philippines. PSA notes that Germany has recently re-entered the list of top investors.

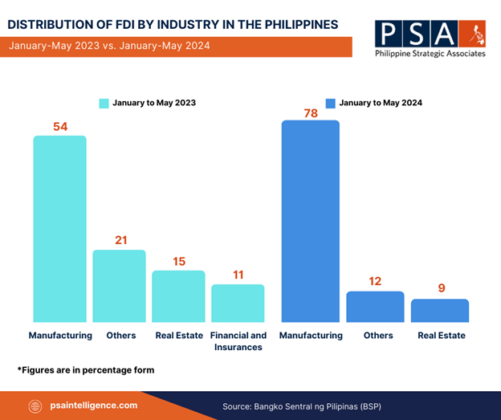

Distribution of Foreign Direct Investment by Industry in the Philippines (January to May 2023 vs. January to May 2024)

Manufacturing dominated FDI in the Philippines from January to May 2023 and 2024, showing growth in 2024. The “Others” category declined slightly. Real estate held steady, while financial and insurance sectors saw minor decreases.

Insights from Economists

Analysts pointed to outside factors contributing heavily to the stagnant FDI inflows to the Philippines. Security Bank Corp.’s Chief Economist, Robert Dan J. Roces, observed a slowdown in FDI for May 2024. He attributed this deceleration to global economic uncertainties, domestic challenges, and increased regional competition. Meanwhile, Rizal Commercial Banking Corp.’s Chief Economist, Michael L. Ricafort, noted that risk aversion due to geopolitical tensions, specifically the direct attacks between Iran and Israel in April, contributed to the lower FDI. Both economists highlighted that elevated global and local interest rates, along with high prices, significantly impacted FDI.

The Philippines recently has completed a wave of investor friendly reforms at the end of the Duterte administration and start of the Marcos administration, most notably the passage of the Public Service Act opening a wide range of Philippine infrastructure to foreign investment. Yet so far, perhaps because of external factors, the Philippines has yet to see a surge of foreign investment compared to previous years.