BSP Raises Interest Rates Another 50 Basis-Points to 3.75 percent

August 23, 2022

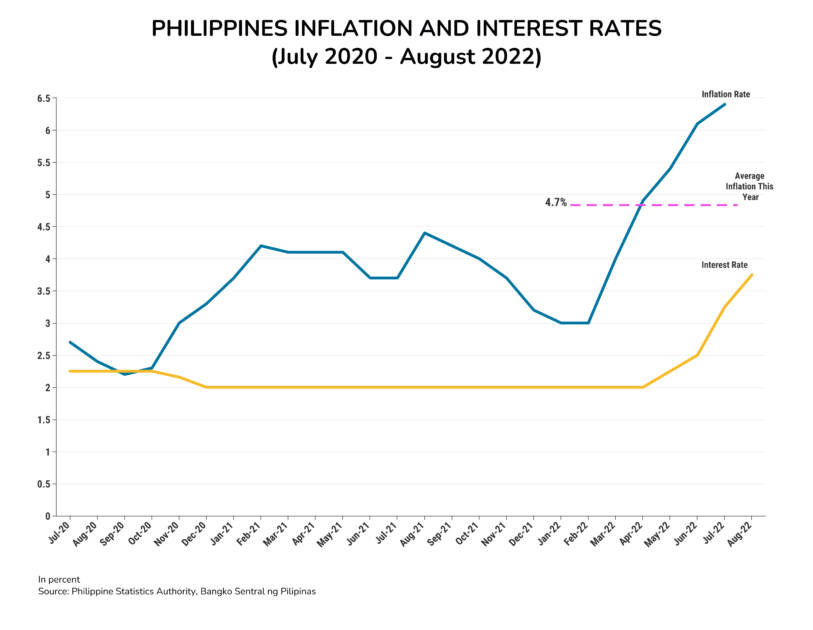

The Bangko Sentral ng Pilipinas (BSP) moved in line with expectations last Thursday, August 18, raising its key benchmark interest rate by 50 basis-points (0.5 percent). Interest rates had been at a record-low 2 percent as part of the government’s efforts to support the economy through the COVID-19 pandemic. The overnight reverse repurchase rate now stands at 3.75 percent, with the BSP hiking interest rates a total of 175 basis-points so far this year, as the nation’s central bank has adopted a more hawkish monetary stance to clamp down on surging inflation. The BSP also raised its 2022 inflation outlook to 5.4 percent from its previous guidance of 5 percent. PSA notes that interest rates are still below the pre-pandemic level of 4 percent.

BSP Governor Felipe M. Medalla said he would not rule out additional interest rate hikes this year, but acknowledged that “it’s hard to forecast…how many rate hikes that would require,” noting that external developments may ease prevailing inflation. Governor Medalla also told the public that he is expecting inflation to peak in September or October.

For its part, Fitch Solutions Country Risk & Research is expecting the BSP to enact a further 75 basis-points in interest rate hikes, bringing the key rate to 4.5 percent before year-end 2022. In Fitch’s view, “a combination of strong economic growth and an elevated inflationary backdrop will prompt the BSP to remain hawkish.” Fitch further noted that “the ongoing Russia-Ukraine war and adverse weather conditions in several food-producing countries in the region,” would result in the Philippines seeing continued “upward price pressure” in energy and food. In sum however, Fitch’s outlook was relatively optimistic, stating that they “believe that the Philippines’ economic resilience will also provide more room for the central bank to normalize its monetary policy.”